17 min read

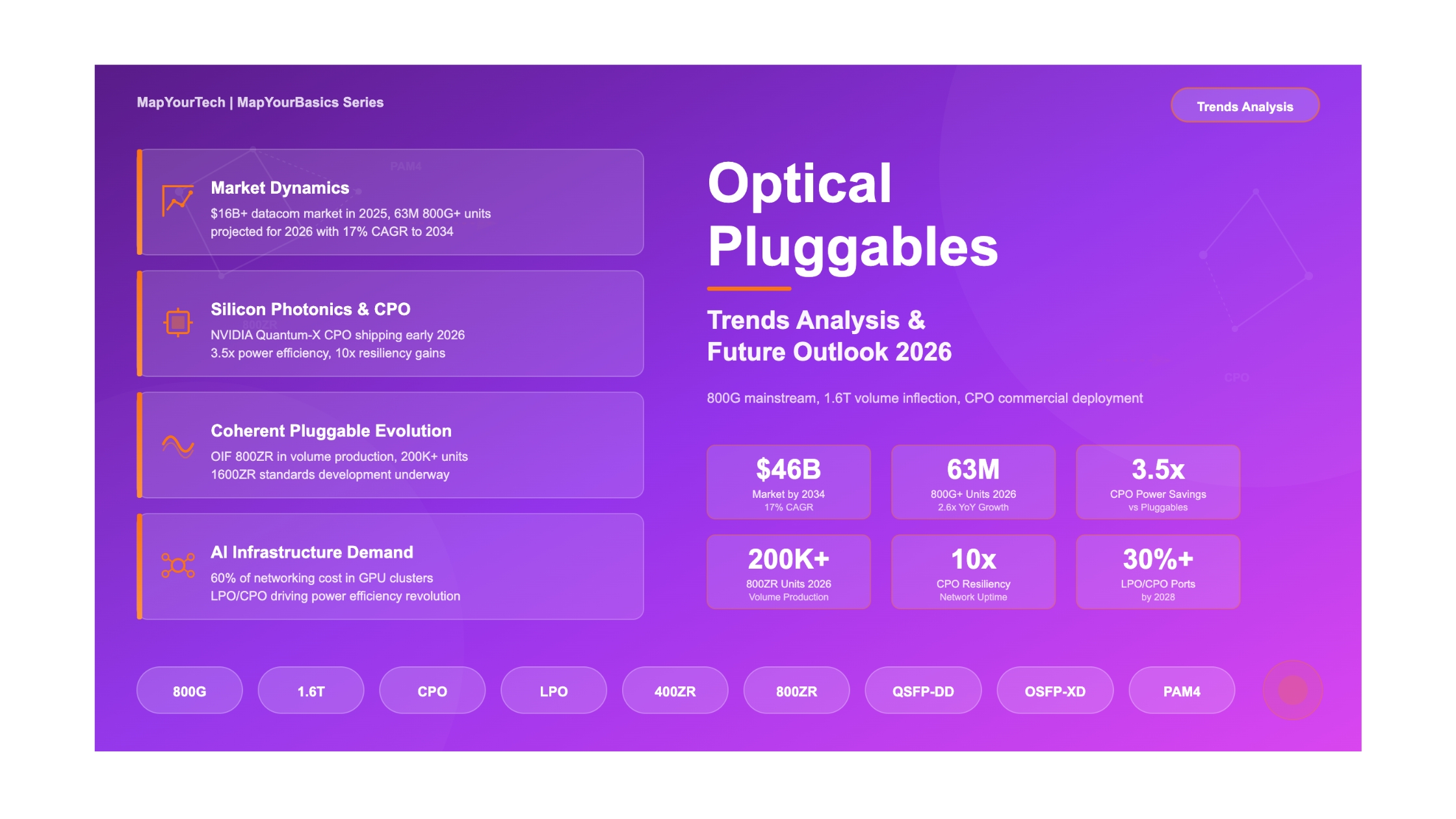

Optical Pluggables: Trends Analysis & Future Outlook

Comprehensive analysis of the optical transceiver market evolution from 400G through 1.6T, examining technology innovations, market dynamics, and strategic implications for the next decade of optical networking.

Introduction

The optical pluggable transceiver market has reached a critical inflection point as we enter 2026, driven by the explosive growth of artificial intelligence workloads, hyperscale data center expansion, and the relentless demand for higher bandwidth connectivity. What began as a steady evolution from 100G to 400G transceivers has transformed into a rapid acceleration toward 800G and 1.6T solutions—with 800G now firmly mainstream and 1.6T entering its volume production phase. NVIDIA's co-packaged optics (CPO) switches are beginning commercial deployment this quarter, marking a fundamental shift in how network architects approach data center design.

This analysis examines the current state of optical pluggable technology as of January 2026, identifies emerging trends that will define the market through 2030 and beyond, and provides strategic recommendations for network operators, equipment manufacturers, and technology investors navigating this rapidly evolving landscape. The scope encompasses datacom transceivers for intra-datacenter applications, coherent pluggables for metro and long-haul networks, and emerging technologies including silicon photonics, co-packaged optics (CPO), and linear-drive pluggable optics (LPO) that are now redefining the boundaries of optical interconnect performance and efficiency.

Current State: The Optical Pluggable Landscape in Early 2026

1.1 Market Overview and Key Metrics

The datacom optical component market exceeded $16 billion in revenue in 2025, representing growth of over 60% year-over-year. This surge was almost entirely attributable to the deployment of 800G optics within artificial intelligence training clusters, where the ratio of optical transceivers to GPUs increased dramatically to support low-latency parameter synchronization across distributed computing architectures. As we enter 2026, the market is experiencing a massive volume inflection with 800G and higher-speed transceiver shipments projected to reach 63 million units—a 2.6× increase from 2025's 24 million units.

Optical Transceiver Market Size Projection

Global market value and growth trajectory (2022-2031)

Deployments of 400G and higher-speed optical transceivers grew by 250% year-over-year in 2024, with 2025 delivering sustained high growth of over 60%. Shipments of 800G optical transceivers achieved a year-on-year increase of approximately 100% in 2025. Now in early 2026, 1.6T products are entering volume production—this is the "main upswing" period for 1.6T technology that industry analysts predicted. Meanwhile, 3.2T technology is under accelerated development with initial samples expected later this year.

High-Speed Transceiver Shipments by Data Rate

Annual unit shipments for 400G, 800G, and 1.6T modules (millions)

1.2 Form Factor Evolution

The optical transceiver form factor landscape has consolidated around two primary high-density options: QSFP-DD (Quad Small Form Factor Pluggable Double Density) and OSFP (Octal Small Form Factor Pluggable). Both form factors support 400G and 800G data rates, with newer variants like OSFP-XD designed to accommodate the thermal and electrical requirements of 1.6T transceivers. Industry standardization efforts led by the Open Compute Project have now prioritized OSFP-XD as the primary 1.6T carrier, with 92% of 2025 hyperscale data center contracts specifying this form factor for its 224G SerDes readiness.

| Form Factor | Max Data Rate | Power Budget | Lanes | Primary Application |

|---|---|---|---|---|

| QSFP-DD | 800G (8×100G) | 14W-18W | 8 lanes | Data center, DCI |

| OSFP | 800G (8×100G) | 21W | 8 lanes | High-performance compute |

| OSFP-XD | 1.6T (8×200G) | 30W+ | 8 lanes | AI clusters, future networks |

| QSFP28 | 100G (4×25G) | 3.5W | 4 lanes | Enterprise, legacy DC |

Table 1: Comparison of current pluggable transceiver form factors

Form Factor Power Comparison

Maximum power budget by form factor (Watts)

Market Demand by Segment

2025 market share distribution

1.3 Technology Baseline Assessment

The current optical pluggable ecosystem operates across three distinct technology domains, each serving specific market segments and distance requirements:

Direct-Detect Datacom Optics

Serving intra-datacenter applications with reaches from 100m (SR multimode) to 10km (LR single mode). PAM4 modulation has become the standard for 100G per lane operation, enabling 400G (4×100G) and 800G (8×100G) aggregate data rates. These modules typically operate at 850nm (multimode) or 1310nm (single mode) wavelengths and represent the highest volume segment of the market.

Coherent Pluggable Optics

400ZR and ZR+ coherent optics have become the most widely adopted coherent technology in history, enabling direct DWDM connectivity from routers and switches without external transport equipment. Over 70% of coherent ports deployed today utilize pluggable form factors. The OIF released the 800ZR Implementation Agreement in November 2024, and 800ZR/ZR+ modules are now shipping in volume with forecasts exceeding 200,000 units by end of 2026. The OIF is actively developing 1600ZR and 1600ZR+ standards, with some hyperscalers indicating they may skip 800ZR to wait for 1600ZR. The coherent pluggable market generated $2 billion in revenue in 2025 and is projected to reach nearly $5 billion by 2029.

CWDM/LWDM Metro Solutions

Coarse and LAN wavelength division multiplexing solutions (400GBASE-LR4, FR4) provide intermediate reach options (2km to 10km) using multiple wavelengths per fiber. These solutions balance cost, power consumption, and reach for campus and metro aggregation applications without requiring coherent detection.

Market Concentration

Hyperscale data centers account for over 70% of high-speed optical transceiver demand. Cloud providers including Amazon, Google, and Microsoft drive innovation in areas like coherent modulation, silicon photonics, and advanced packaging techniques. Chinese manufacturers Innolight and Eoptolink have secured approximately 60% of Nvidia's incremental 800G orders for 2025, while Western suppliers Coherent and Lumentum provide supply chain balance and vertically integrated laser technology.

Emerging Trends: Technology Innovations Reshaping the Market

2.1 The Transition to 200G Per Lane

The silicon photonics industry is transitioning to higher data rates, with 200G per channel links expected to become mainstream in 2026-2027. This evolution paves the way for 800G and 1600G transceivers that deliver the speed and energy efficiency that hyperscale data centers and AI clusters require. The move from 100G per lane (NRZ/PAM4) to 200G per lane (PAM4 at higher baud rates) represents a critical inflection point that will determine competitive positioning for the next generation of products.

Per-Lane Speed Evolution Timeline

Electrical and optical lane speeds by technology generation (Gbps)

Technology Milestone

In April 2025, Jabil Inc. launched 1.6T transceivers capable of transmitting data at 1.6 Terabits per second, expanding its photonics portfolio to support growing AI/ML workloads, HPC, cloud computing, and high-speed data center interconnects. This represents one of the first commercial 1.6T pluggable products entering the market.

2.2 Silicon Photonics Integration

Silicon photonics has emerged as a transformative technology enabling the next wave of optical transceiver innovation. By integrating optical components directly on silicon chips using CMOS-compatible manufacturing processes, vendors can achieve higher integration density, lower power consumption, and reduced cost per bit compared to traditional discrete component approaches.

The industrial ecosystem brings together vertically integrated leaders such as TeraHop (formerly InnoLight), Cisco, Broadcom, and Marvell, alongside innovative startups including Ayar Labs, Lightmatter, Celestial AI, and Nubis Communications. China has emerged as a key competitor, shipping millions of modules and closing the technology gap with Western suppliers.

| Technology Approach | Key Benefits | Challenges | Market Readiness |

|---|---|---|---|

| Silicon Photonics (SOI) | CMOS compatible, scalable, lower cost | Laser integration, thermal management | Volume production |

| Indium Phosphide (InP) | Superior optical performance, monolithic lasers | Higher cost, smaller wafers | Volume production |

| Thin-Film Lithium Niobate (TFLN) | Ultra-high bandwidth, low loss modulators | Process maturity, integration | Early production |

| Hybrid Integration | Best of both worlds, flexibility | Assembly complexity | Volume production |

Table 2: Comparison of photonic integration platforms

2.3 Co-Packaged Optics (CPO): Commercial Breakthrough in 2026

Co-packaged optics integrates optical transceivers directly with switch ASICs or processors on the same package substrate, enabling low-power, high-bandwidth links that eliminate the electrical losses and signal degradation associated with traditional pluggable module connections. At GTC 2025, NVIDIA introduced two new networking switch platforms, Spectrum-X Photonics and Quantum-X Photonics, both built on co-packaged optics using TSMC's Compact Universal Photonic Engine (COUPE) technology. In a landmark achievement, Broadcom and Meta achieved one million link hours without a single link flap in high-temperature lab characterization (October 2025), demonstrating production-grade reliability.

Breaking News: CPO Entering Production

NVIDIA Quantum-X InfiniBand switches with CPO are shipping in early 2026 (NOW), delivering 115 Tb/s of throughput with 144 ports at 800 Gb/s each. NVIDIA Spectrum-X Ethernet switches with CPO will follow in H2 2026, supporting up to 409.6 Tb/s with 512 ports at 800 Gb/s. This marks the commercial breakthrough year for silicon photonics CPO technology.

CPO vs. Traditional Pluggables: Performance Comparison

Key metrics comparison showing CPO advantages

By integrating the laser and optical modulators directly onto the chiplet, CPO reduces power consumption by 3.5× compared to traditional pluggable modules while simultaneously cutting latency from microseconds to nanoseconds. The market research firm IDTechEx forecasts that the co-packaged optics market will rise at a compound annual growth rate of 37% from 2026 to more than $20 billion by 2036.

2.4 Linear-Drive Pluggable Optics (LPO)

Linear Pluggable Optics represents an intermediate evolution between traditional DSP-based transceivers and co-packaged optics. By eliminating the digital signal processor (DSP) from the transceiver module and relying on the host ASIC for signal conditioning, LPO modules reduce power consumption by approximately 40-50% while cutting latency to near-zero levels critical for AI workloads. In March 2025, the LPO MSA issued the finalized specification for 100 Gb/s-per-lane single-mode linear pluggable optical modules, targeting 800 GbE connectivity with validated interoperability across system, module, and IC vendors.

Power Consumption Comparison

800G module power by technology (Watts)

Energy Efficiency Trajectory

Energy per bit by technology generation (pJ/bit)

LPO Benefits and Trade-offs

LPO technology is gaining traction as a low-power, cost-effective alternative to DSP-based optics. Key demonstrations at OFC 2024 and 2025 by Eoptolink, MACOM, Marvell, Alphawave, and Innolight showcased systems spanning 100G to 200G per lane. The global LPO market reached $2.1 billion in 2024 and is forecast to achieve $5.4 billion by 2033 at an 11.1% CAGR. LPO/CPO ports are expected to account for more than 30% of total 800G and 1.6T ports deployed in 2026-2028.

A switch equipped with 64 LPO modules ran 14°C cooler than a switch with 64 standard 800G transceivers, demonstrating the thermal management benefits. However, LPO requires careful engineering for robust links due to the lack of DSP-based equalization and is optimized primarily for short-reach (0-2km) applications where optical paths are predictable and clean.

Linear Receive Optics (LRO) has emerged as a middle-ground solution that retains the transmit DSP while eliminating the receive DSP. This approach achieves approximately 30% power reduction compared to fully retimed optics while maintaining IEEE-compliant optical transmit signaling and improved interoperability with legacy equipment.

2.5 Coherent Pluggable Evolution: 800ZR to 1600ZR

The coherent pluggable market continues to expand both in volume and capability. 400ZR and ZR+ coherent optics became the most widely adopted coherent technology in history, with Cisco/Acacia emerging as a market leader with over 250,000 400G MSA coherent pluggable ports shipped. The OIF released the 800ZR Implementation Agreement in November 2024, and multiple vendors including Cisco, Acacia, Ciena, and Coherent are now shipping 800ZR/ZR+ modules in volume. Notably, some hyperscalers are adopting a two-speed strategy—deploying 800ZR/ZR+ for current needs while others like Microsoft are waiting for 1600ZR standards completion, opting to skip 800G and deploy 400ZR until 1600ZR is available.

Coherent Pluggable Module Shipment Forecast

Projected shipments by generation (thousands of units)

| Standard | Data Rate | Reach (Amplified) | Reach (Unamplified) | Status |

|---|---|---|---|---|

| OIF 400ZR | 400G single-carrier | 80-120km | N/A | Volume production |

| OpenZR+ | 100G-400G | 500km+ | N/A | Volume production |

| OIF 800ZR | 800G single-carrier | 80-120km | 2-10km (campus) | Volume production (200K+ units by 2026) |

| OIF 1600ZR | 1.6T single-carrier | TBD | TBD | IA development (IEEE 802.3dj mid-2026) |

Table 3: Evolution of coherent pluggable standards

Infrastructure providers have reported dramatic benefits from IP-over-DWDM architectures enabled by coherent pluggables. Colt Technology Services reported 97% energy savings compared to traditional layered network architectures, while Arelion saved 64% in CapEx and 76% in OpEx by deploying router-based coherent optics.

2.6 AI as the Dominant Demand Driver

Artificial intelligence has fundamentally altered the buyer-supplier dynamic in the optical transceiver market. The architecture of NVIDIA's NVL72 rack system, which connects up to 72 GPUs via the NVLink switch system, requires an unprecedented density of optical interconnects. A single GB200 cluster comprising 576 GPUs necessitates approximately 18,432 single-ended 800G optical modules.

AI Network Bandwidth Requirements

In a GB300 NVL72 Cluster with a 3-Layer InfiniBand network, optical transceivers account for approximately 60% of networking cost and 45% of total networking power. Each GPU requires six pluggable transceivers, with each consuming around 30 watts. At scale, connecting a million GPUs would consume approximately 180MW from transceivers alone, driving urgent demand for more efficient solutions including CPO and LPO technologies.

Short-Term Outlook: Now Through 2027

3.1 800G Now Mainstream, 1.6T Volume Inflection Begins

800G has become the mainstream standard, replacing 400G as the preferred choice for data center network upgrades. As of Q2 2025, LightCounting reported a 10% quarter-over-quarter increase led by 800G modules. The 2025 market delivered over 24 million 800G+ transceiver shipments, and 2026 is projected to see 63 million units—a 2.6× increase. The high-speed datacom optical market expanded from about $9 billion in 2024 to nearly $12 billion in 2026 as 800G growth reaches its peak and 1.6T begins its volume ramp.

3.2 Immediate Technology Developments

Several key technology developments will shape the near-term market:

5nm DSP Adoption

The new generation of coherent and datacom transceivers leverages 5nm and 4nm process technology for their digital signal processors, offering significant power and performance improvements over the 7nm technology used in current 400G transceivers.

800ZR Interoperability

OIF-led plugfest methodologies have validated multi-vendor interoperability for 800ZR coherent interfaces, enabling broader adoption across network architectures and vendor ecosystems.

OSFP-XD Form Factor

The OSFP-XD (Extended Density) form factor addresses thermal and electrical requirements for 1.6T transceivers, supporting power budgets exceeding 30W necessary for high-performance 200G per lane operation.

L-Band Coherent Expansion

Vendors including Lumentum have begun sampling 400/800G ZR+ L-band pluggable transceivers alongside C-band modules, enabling capacity expansion on existing fiber infrastructure.

3.3 Investment Priorities

Network operators and equipment manufacturers should prioritize the following near-term investments:

Infrastructure Readiness

Audit existing switch and router platforms for 800G/1.6T compatibility. Verify thermal management capacity for higher-power modules (14W to 30W per port). Evaluate PCB materials and connector specifications for 200G per lane electrical interfaces. Plan fiber infrastructure upgrades to support increased wavelength counts and extended DWDM deployments.

Medium-Term Projections: 2027-2030

4.1 Market Transformation

The optical transceiver market is projected to reach approximately $24 billion by 2029 and $36.73 billion by 2031, with a longer-term trajectory to $46 billion by 2034 at a 17% CAGR. AI cluster optical transceivers specifically are expected to double from $5 billion in 2024 to $10 billion in 2026 according to LightCounting, with continued strong growth through the decade. This growth will be driven by continued data center expansion, 5G/6G network densification, and the proliferation of AI workloads across enterprise and cloud environments.

Technology Adoption S-Curves

Projected market penetration by data rate technology (% of shipments)

The pluggable optics market specifically was valued at $5.6 billion in 2024 and is projected to reach $9.9 billion by 2030, with a CAGR of 9.8%. However, this represents only the pluggable segment and does not include the emerging CPO market, which will begin contributing significant revenue by the end of this period.

4.2 Technology Evolution Milestones

1.6T and 3.2T Volume Deployment

By 2027-2028, 1.6T transceivers will achieve mainstream adoption in AI backend networks and hyperscale data centers. Initial 3.2T technology development will accelerate, with early sampling expected by 2028-2029. The transition to 400G per lane electrical interfaces will enable single-module 3.2T capacity in familiar form factors.

CPO Scale Deployment

Large-scale CPO deployments are projected between 2028 and 2030. While linear-drive pluggable modules will remain competitive, CPO is expected to offer unmatched customization and scalability for the most demanding AI and HPC applications. CPO network switches are expected to dominate revenue generation, driven by each switch potentially incorporating up to 16 CPO photonic integrated circuits.

Coherent Technology Advancement

1600ZR/ZR+ standards will mature, enabling multi-terabit coherent connectivity directly from router platforms. Advanced DSPs using 3nm and beyond process nodes will push baud rates above 140 Gbaud, approaching the theoretical limits of current modulator technology. Multi-rail optical transport concepts will enable dramatic increases in line system capacity.

4.3 Competitive Landscape Shifts

The competitive dynamics of the optical transceiver market will undergo significant transformation during this period. Traditional equipment manufacturers are working to break the 400G stronghold that top vendors have established by aggressively targeting pluggables with their own DSPs. Infinera has been public about plans to deliver 800G pluggables and wins with major hyperscalers, while Nokia has always maintained an internal DSP capability.

Chinese manufacturers including Innolight, Eoptolink, and Accelink continue to expand market share while final assembly for North American shipments increasingly shifts to Southeast Asia (Thailand, Vietnam) to mitigate trade restrictions. Engineering control, supply-chain orchestration, and scale economics remain anchored in China, while critical DSP and laser IP remains concentrated with US firms.

Supply Chain Considerations

The market has split into two distinct, symbiotically linked ecosystems: the high-volume, agile manufacturing base in China and the vertically integrated, intellectual property-rich incumbents in the United States. Network operators should maintain supply chain diversification strategies while monitoring geopolitical developments that could impact component availability and pricing.

Long-Term Vision: 5-10 Years (2030-2035)

5.1 Technology Convergence

The distinction between pluggable optics and integrated photonics will increasingly blur as advanced packaging technologies enable hybrid architectures. Expect systems that combine the flexibility of pluggable modules for lower-bandwidth ports with CPO for the highest-bandwidth switch-to-switch interconnects within a single platform.

The "rack is the computer" philosophy will mature, with entire rack systems or multiple rows of racks functioning as single processors connected by high-bandwidth, low-latency optical fabrics. This architectural evolution requires optical interconnects capable of sub-nanosecond latency and multi-terabit aggregate bandwidth per computing node.

5.2 Breakthrough Technologies

Sub-Picojoule-Per-Bit Efficiency

Current pluggable transceivers operate at approximately 15 pJ/bit, while CPO demonstrations have achieved approximately 5 pJ/bit. Research prototypes demonstrate paths to sub-1 pJ/bit efficiency, which would enable sustainable scaling of AI data centers without proportional increases in power consumption. This represents a potential 15× improvement in energy efficiency over current pluggable technology.

Universal Chiplet Interconnect

Optical I/O chiplets based on standards like UCIe (Universal Chiplet Interconnect Express) will enable interoperable die-to-die optical communication across vendor boundaries. Ayar Labs has announced the first UCIe optical chiplet capable of achieving 8 Tbps bandwidth, representing a breakthrough toward standardized optical I/O at the package level.

5.3 Societal and Environmental Impact

Before widespread adoption of CPO and advanced efficiency technologies, the power trajectory of AI data centers was unsustainable, with some estimates suggesting they would consume 10% of global electricity by 2030. Silicon photonics and advanced packaging technologies have the potential to bend that curve significantly.

By reducing the energy required for data movement by over 60% compared to current solutions, the industry can continue scaling compute power while keeping energy growth manageable. This positions optical interconnect technology as a critical enabler of sustainable AI development and responsible technology deployment.

Energy Efficiency Trajectory

Traditional Pluggable: ~15 pJ/bit

Current CPO: ~5 pJ/bit (3.5× improvement)

Research Target: <1 pJ/bit (15× improvement)

Power Impact Example (1M GPU cluster):

Transceivers @ 15 pJ/bit: 180 MW

Transceivers @ 5 pJ/bit: 51 MW (129 MW savings)

Transceivers @ 1 pJ/bit: 10 MW (170 MW savings)Strategic Recommendations

6.1 For Network Operators

Audit Current Infrastructure

Document existing 400G module counts, power consumption, and vendor compatibility. Evaluate switch and router platforms for 800G/1.6T upgrade paths. Assess thermal management capacity for higher-power modules.

Accelerate 800G Deployment

With 800G now mainstream and mature, accelerate deployment for new builds and high-bandwidth clusters. For next-generation AI infrastructure, evaluate 1.6T options now entering volume production. Compare DSP-based, LPO, and emerging LRO solutions for your specific reach requirements.

Evaluate ROI Carefully

Estimate fiber savings, port reduction, and power-per-bit improvements when comparing technology options. Consider total cost of ownership including operational expenses, not just module pricing.

Evaluate CPO Options

NVIDIA Quantum-X InfiniBand CPO switches are shipping now (early 2026). Evaluate whether your AI/HPC workloads warrant early CPO adoption for the 3.5× power efficiency gain. Monitor Spectrum-X Ethernet CPO availability (H2 2026) for broader deployment options.

6.2 For Equipment Manufacturers

Product Development Priorities

Focus R&D investment on 200G per lane technology enablement across all form factors. Develop platform architectures that support both pluggable and CPO options to address diverse customer requirements. Invest in thermal management solutions for high-power density deployments. Ensure compatibility with emerging standards including 800ZR, 1600ZR, and UCIe optical I/O.

6.3 Risk Mitigation

Key Risks to Monitor

Geopolitical uncertainty: Trade restrictions and tariffs could disrupt supply chains concentrated in specific regions. Maintain diversified supplier relationships across geographies. Technology timing: Early adoption of emerging technologies (CPO, LPO) carries integration risk. Balance innovation with proven reliability requirements. Standards fragmentation: Multiple competing standards and MSAs could slow market consolidation. Engage actively in standards bodies to influence direction.

Key Takeaways

- 800G transceivers achieved mainstream status in 2025, with 1.6T now entering volume production in early 2026 (63M+ 800G+ units projected for 2026)

- NVIDIA's Quantum-X InfiniBand CPO switches are shipping NOW (early 2026), with Spectrum-X Ethernet CPO following in H2 2026

- AI workloads remain the dominant demand driver, with optical transceivers representing 60% of networking cost in large GPU clusters

- Coherent pluggables continue rapid growth—800ZR/ZR+ in volume production with 200K+ units forecast for 2026; OIF developing 1600ZR standards

- Network operators should plan hybrid architectures supporting both pluggable flexibility and emerging CPO/LPO efficiency options

References

- [1] Cignal AI – Optical Components Report: 800GbE Optics Shipments to Grow 60% in 2025

- [2] Optical Internetworking Forum (OIF) – 400ZR, 800ZR Implementation Agreements (800ZR IA Released November 2024)

- [3] IEEE 802.3dj – 200G/lane PAM4 Signaling Standard (Expected Mid-2026 Finalization)

- [4] Yole Group – Silicon Photonics 2025 and Co-Packaged Optics for Data Centers 2025

- [5] IDTechEx – Co-Packaged Optics (CPO) Market Forecast: $20B by 2036 at 37% CAGR

- [6] NVIDIA Technical Blog – Scaling AI Factories with Co-Packaged Optics (September 2025)

- [7] LPO MSA – 100G-DR-LPO Specification (Finalized March 2025)

- [8] TrendForce – 800G+ Transceiver Shipments to Reach 63M Units in 2026

- [9] LightCounting – Updated Forecast for Sales of Ethernet Transceivers, LPO and CPO

- [10] Sanjay Yadav, "Optical Network Communications: An Engineer's Perspective" – Bridge the Gap Between Theory and Practice in Optical Networking

Developed by MapYourTech Team

For educational purposes in Optical Networking Communications TechnologiesNote: This guide is based on industry standards, best practices, and real-world implementation experiences. Specific implementations may vary based on equipment vendors, network topology, and regulatory requirements. Always consult with qualified network engineers and follow vendor documentation for actual deployments.

Feedback Welcome: If you have any suggestions, corrections, or improvements to propose, please feel free to write to us at feedback@mapyourtech.com

Unlock Premium Content

Join over 400K+ optical network professionals worldwide. Access premium courses, advanced engineering tools, and exclusive industry insights.

Already have an account? Log in here