11 min read

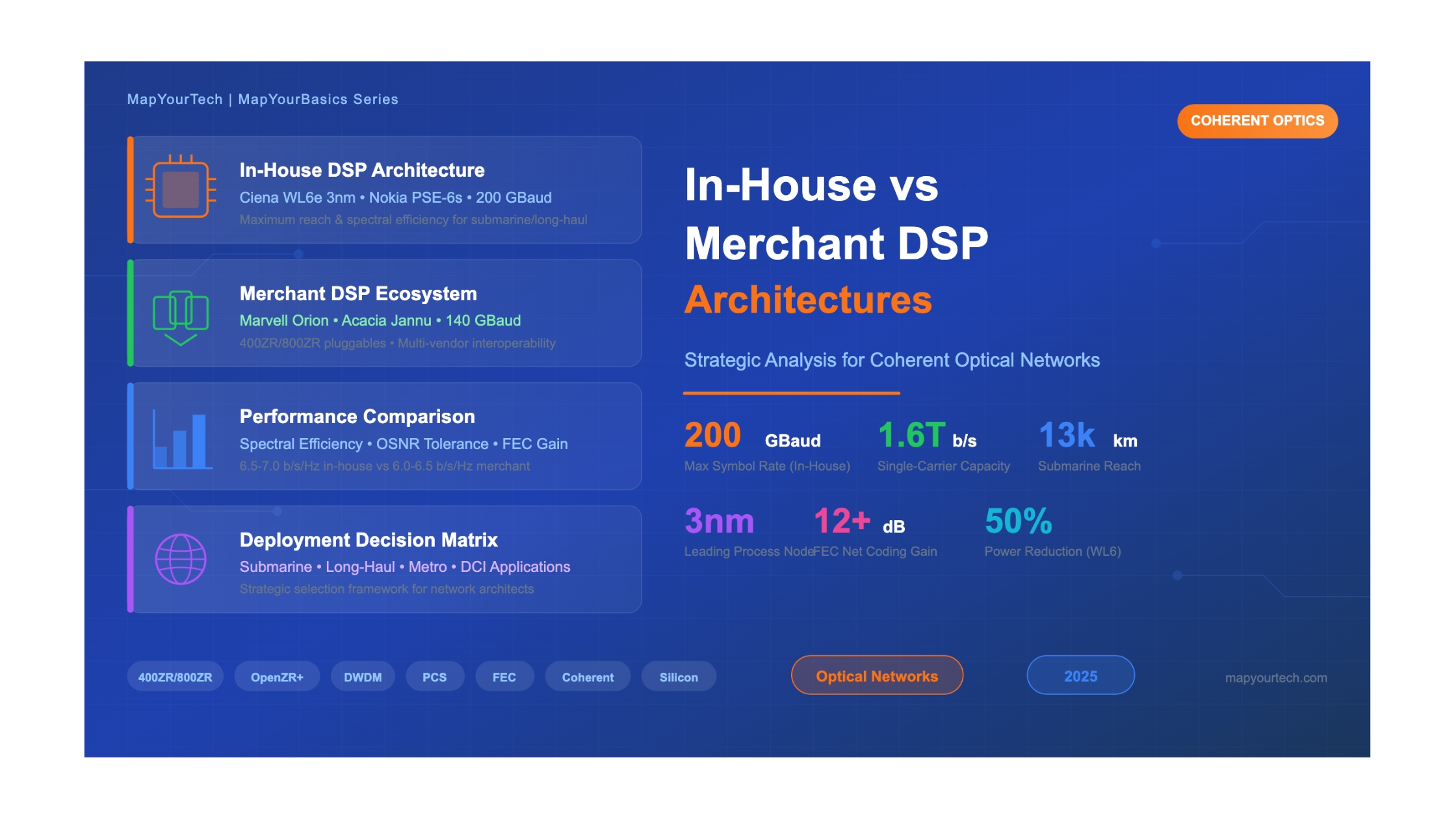

In-House vs Merchant DSP Architectures in Coherent Optical Networks

A Comprehensive Technical Analysis of Digital Signal Processor Development Strategies, Performance Trade-offs, and Market Dynamics in Modern DWDM Systems (2025 Edition)

Introduction

The Digital Signal Processor (DSP) represents the intellectual core of modern coherent optical transmission systems. Since the commercial introduction of coherent detection around 2008, DSP technology has evolved from enabling basic 40G transmission to becoming the central determinant of system performance at 400G, 800G, and now 1.6T wavelengths. The DSP performs critical functions including chromatic dispersion compensation, polarization mode dispersion mitigation, nonlinear effect equalization, forward error correction (FEC), carrier recovery, and adaptive modulation.

The architectural choice between in-house (proprietary) and merchant (third-party) DSP development carries profound implications across technical, economic, and strategic dimensions. In-house development enables tight co-optimization between the DSP, optical front-end, and system software, delivering maximum performance for demanding applications such as submarine and ultra-long-haul terrestrial networks. Merchant DSP solutions provide standardized building blocks that enable faster market entry, multi-vendor interoperability through specifications like OIF 400ZR and 800ZR, and volume economics that benefit from aggregated demand.

The year 2024 marked a pivotal moment: for the first time, pluggable coherent module shipments exceeded embedded coherent port shipments. This transition, driven primarily by merchant DSP-based solutions, signals a fundamental restructuring of the optical transport market. The performance gap between embedded (in-house) and pluggable (merchant) solutions has compressed from 4 years at 100G to less than 1 year at 800G.

The Strategic Bifurcation

The coherent optical networking industry has split decisively along two development paths. Vertically-integrated vendors with in-house DSPs continue to dominate high-performance applications, achieving spectral efficiencies within 1-2 dB of Shannon limits. Meanwhile, merchant DSPs have democratized 400G-800G pluggable coherent for data center interconnect (DCI) with compound annual growth rates exceeding 100% since 2022.

In-House DSP Leadership

Ciena, Nokia/Infinera, and Huawei maintain proprietary DSP development for maximum performance differentiation

Merchant Ecosystem Scale

Marvell and Cisco/Acacia supply 15+ module manufacturers, creating competitive pricing through volume

Standards Convergence

OIF 400ZR, 800ZR, and emerging 1600ZR specifications drive interoperability across the ecosystem

Performance Gap Closing

In-house DSPs retain a 10-20% advantage in reach and spectral efficiency, but merchant solutions now meet requirements for metro/DCI applications (85%+ of deployments)

Historical Context and Technology Evolution

The evolution of coherent DSP technology traces a remarkable trajectory from the first commercial deployments in 2008 to today's 1.6T wavelengths. Each generation has delivered approximately 2× capacity at similar power levels by combining silicon node advances with algorithmic innovations in forward error correction, probabilistic constellation shaping, and nonlinear compensation.

Silicon Node Progression

Silicon process node advancement has followed a predictable cadence that directly enables coherent DSP capability improvements. The 28nm CMOS node enabled 100G coherent circa 2012. The 16nm generation pushed systems to 200-400G by 2016, while 7nm unlocked 600-800G starting in 2019. Current 5nm technology enables 800G-1.2T commercial deployments. Most significantly, Ciena made the strategic decision to skip 5nm entirely, jumping directly from 7nm to 3nm for WaveLogic 6 Extreme, delivering 200 GBaud symbol rates and 1.6 Tb/s single-carrier wavelengths by late 2024.

40G/100G Coherent Introduction

First commercial coherent systems using 40nm/28nm CMOS. DSP enabled QPSK modulation with basic CD and PMD compensation. All DSPs were proprietary in-house developments.

200G-400G with Soft-Decision FEC

16nm/7nm nodes enabled higher-order modulation (16QAM, 64QAM). Nokia pioneered probabilistic constellation shaping with PSE-3. Merchant DSPs emerged for CFP2-DCO modules.

OIF 400ZR Transforms the Market

OIF 400ZR specification released March 2020, driving hyperscaler adoption. Marvell Canopus (7nm) became the dominant merchant DSP. QSFP-DD pluggables entered production.

800G/1.6T and Market Split

Ciena WaveLogic 6 (3nm, 200 GBaud) leads in-house. Marvell Orion (5nm, 130 GBaud) dominates merchant. 2024: First year pluggables exceed embedded shipments. OIF 800ZR released October 2024.

The Baud Rate Wars

Symbol rate (baud rate) has emerged as the primary competitive metric defining coherent DSP generations. Increasing baud rate allows higher data transmission without increasing modulation complexity, which is critical because higher-order formats require exponentially higher OSNR.

| Vendor | Platform | Max Baud Rate | Process Node | Availability |

|---|---|---|---|---|

| Ciena | WaveLogic 6 Extreme | 200 GBaud | 3nm | Oct 2024 |

| Infinera | ICE7 | 148 GBaud | 5nm | Oct 2024 |

| Cisco/Acacia | CIM-8 (Jannu) | 140 GBaud | 5nm | Late 2022 |

| Nokia | PSE-6s | 130+ GBaud | 5nm | H2 2023 |

| Marvell | Orion | ~130 GBaud | 5nm | 2023 |

Ciena's 200 GBaud capability positions them a full generation ahead of competitors. The gap between 200 GBaud and 130 GBaud (54% higher) to 148 GBaud (35% higher) translates directly into increased spectral efficiency or extended reach at equivalent data rates.

Ribbon Communications successfully completed a 20 Tbps transmission trial on the JUNO trans-Pacific cable spanning 10,000 km. The trial featured Ribbon's Apollo 9408 transponder (5nm, 140 GBaud, 400 Gbps-1.2 Tbps per wavelength) combined with the Apollo 9608 optical line system platform integrating submarine-grade OLS functions. Ribbon joined the elite submarine line terminal equipment (SLTE) club previously dominated by Ciena and Nokia/Infinera. The JUNO cable, supplied by NEC with 20 fiber pairs and 350 Tbps total capacity, achieved 20 Tbps per fiber pair in the trial, exceeding the original 18 Tbps design target.

AWS has developed proprietary DWDM transponder technology for both metro and long-haul routes, marking the first significant whitebox optical system deployment by a hyperscaler. Development began in 2020 for metro networks, with an updated architecture in January 2024 supporting data center, metro, and long-haul connections. The first 1,500-km long-haul deployment went live in July 2025, delivering 73% bandwidth increase and 35% power reduction versus vendor-sourced equipment. AWS cites full software/hardware control enabling security verification, rapid updates, deep network management integration, and supply chain continuity. According to Dell'Oro Group, this represents a pivotal shift as cloud providers driving 60% YoY growth in DWDM purchasing now explore vertical integration beyond switching into optical transport.

Core Concepts and Fundamentals

Understanding the fundamental differences between in-house and merchant DSP architectures requires examining the core technical concepts that define coherent optical transmission. This section provides the foundational knowledge essential for evaluating DSP solutions across different network applications.

In-House vs Merchant: Architectural Philosophy

In-house DSPs are custom ASICs developed by system vendors for exclusive use in their own transponders and transceiver modules. The key advantage is tight co-optimization between the DSP and the accompanying optics. Merchant DSPs follow a standardization path, implementing industry-defined interface standards for multi-vendor interoperability.

In-House DSP Advantages

- Proprietary FEC implementations optimized for specific channel conditions

- Custom constellation shaping matched to optical front-end characteristics

- Integrated diagnostics with system management software

- Control over silicon roadmap and feature timing

- Maximum reach and spectral efficiency for demanding applications

- Co-packaged thermal management and power optimization

Merchant DSP Advantages

- Standards-compliant interfaces ensuring multi-vendor interoperability

- Configurable FEC options (oFEC, CFEC, GFEC, proprietary)

- Flexible modulation from QPSK through 64QAM with PCS

- Volume economics from aggregated demand across ecosystem

- Faster time-to-market without custom ASIC development

- Multi-source supply chain options reducing vendor lock-in

Forward Error Correction Fundamentals

Forward error correction provides the coding gain essential for practical coherent transmission. FEC represents one of the most significant differentiators between in-house and merchant architectures.

| FEC Type | Net Coding Gain | Standard | Application |

|---|---|---|---|

| CFEC (Concatenated) | 10.8 dB | OIF 400ZR | Pluggable DCI (80-120 km) |

| oFEC (Open FEC) | 11.1-11.6 dB | OpenZR+, 800ZR | Extended reach metro/regional |

| Proprietary SD-LDPC | 12+ dB | Vendor-specific | Long-haul, submarine |

Where C is channel capacity (bits/s), B is bandwidth (Hz), SNR is signal-to-noise ratio, and the factor of 2 accounts for dual-polarization (X and Y) transmission in coherent systems. Modern coherent systems operate within 1-2 dB of this theoretical limit.

Key Architectural Differences

| Characteristic | In-House DSP | Merchant DSP |

|---|---|---|

| Design Philosophy | System-level co-optimization | Modular standardization |

| FEC Implementation | Proprietary SD-LDPC (12+ dB NCG) | Standard oFEC/CFEC (10.8-11.6 dB NCG) |

| Optical Interface | Custom, co-designed with photonics | OIF-standardized electrical interfaces |

| Target Application | Submarine, ultra-long-haul, backbone | Metro, DCI, pluggable modules |

| Development Cost | $100-300M per generation | Shared across ecosystem |

| Time-to-Market | 3-5 year development cycles | ~1 year integration cycle |

| Interoperability | Same vendor required both ends | Multi-vendor certified |

Technical Architecture and Components

The technical architecture of coherent DSPs encompasses multiple functional blocks working in concert to compensate fiber impairments and maximize transmission performance. Understanding these architectural elements is essential for evaluating the trade-offs between in-house and merchant solutions.

DSP Functional Block Diagram

A modern coherent DSP contains several key functional blocks that process the received signal through a complex pipeline. The ADC/DAC subsystem converts between analog optical signals and digital processing domains. Chromatic dispersion (CD) compensation uses frequency-domain equalization to remove accumulated dispersion. Adaptive equalizers track and compensate for polarization mode dispersion (PMD) and other time-varying impairments. Carrier recovery extracts the carrier phase from the modulated signal. Finally, FEC decoding corrects residual errors to achieve the target bit error rate.

In-House DSP: Ciena WaveLogic 6 Extreme Architecture

Ciena's WaveLogic 6 Extreme represents the state-of-the-art in in-house DSP development. Built on a 3nm CMOS process, it achieves 200 GBaud operation with single-carrier capacity of 1.6 Tb/s for metro applications and 800 Gb/s for ultra-long-haul reaches exceeding 10,000 km. Key architectural features include:

- 224G SerDes technology integrated directly into the coherent ASIC

- Ultra-high-bandwidth ADCs/DACs sampling at rates significantly higher than Nyquist

- Multi-dimensional constellation shaping for maximum spectral efficiency

- 50% power-per-bit reduction compared to previous WL5 generation

Merchant DSP: Acacia CIM-8 (Jannu DSP) Architecture

Acacia's Coherent Interconnect Module 8 (CIM-8), powered by the 8th generation Jannu DSP fabricated in 5nm CMOS, represents the industry's first single-carrier 1.2 Tb/s pluggable module. Operating at 140 GBaud, it delivers 1.2 Tb/s for metro/DCI, 800 Gb/s full network coverage across long-haul distances, and 400 Gb/s for ultra-long-haul and submarine transmission. Key architectural innovations include:

- Second Generation 3D-Shaping: Enhanced probabilistic constellation shaping (PCS) algorithms providing continuous modulation, baud rate, and spectral efficiency adjustment with 20% higher spectral efficiency over the previous generation

- 3D Siliconization: Advanced integration technique combining high-speed opto-electronic functions with reduced electrical interconnects for superior signal integrity

- Adaptive Baud Rate: Continuous baud rate adjustment up to 140 GBaud to optimize spectrum utilization across single-span or cascaded ROADM paths

- Advanced SD-FEC: Innovative soft-decision error correction with enhanced nonlinear impairment compensation and 2× faster state-of-polarization (SOP) tracking

- More than 65% power-per-bit savings compared to previous generation, with C and L Band support

Optical Front-End Integration

The interface between the DSP and optical components represents a critical differentiation point. In-house designs enable 3D Siliconization (pioneered by Cisco/Acacia), where high-speed electronics and DSP are mounted directly atop the silicon photonics PIC using vertical copper pillars rather than wire bonds. This minimizes RF path length, reducing signal loss and impedance mismatches. Merchant DSPs typically connect via standardized SerDes interfaces that must accommodate various optical front-ends from different suppliers.

Where SE is spectral efficiency (bits/s/Hz), R_s is symbol rate, m is bits per symbol, FEC_rate is code rate (typically 0.75-0.85), and B_ch is channel bandwidth. Modern systems achieve 6-7 bits/s/Hz in production.

Interactive Simulators

These interactive simulators demonstrate the technical trade-offs between in-house and merchant DSP architectures. Adjust the parameters to explore how different configurations affect system performance.

Simulator 1: DSP Architecture Performance Comparison

Simulator 2: Total Cost of Ownership Analysis

Simulator 3: Power Efficiency Comparison

Simulator 4: Deployment Scenario Analyzer

Practical Applications and Case Studies

Deployment Scenario Decision Matrix

| Application | Recommended DSP | Key Rationale | Example Deployment |

|---|---|---|---|

| Submarine Cable | In-House | Maximum reliability, spectral efficiency, 20-25 year lifetime requirements | Southern Cross 1 Tb/s over 13,500 km (Ciena WL6) |

| Ultra-Long-Haul (>3000 km) | In-House | Proprietary nonlinear compensation, advanced FEC, maximum reach | Telstra 1.6 Tb/s over 736 km terrestrial (Ciena WL6e) |

| Long-Haul (1000-3000 km) | Either | Application-specific; in-house for performance, merchant for cost | Colt 1.2 Tb/s transatlantic Grace Hopper cable |

| Metro (100-1000 km) | Merchant/OpenZR+ | Cost optimization, interoperability, rapid deployment | Microsoft 400ZR regional DCI networks |

| DCI (<120 km) | Merchant/400ZR | Standards-based, multi-vendor, lowest cost per bit | Google/Meta hyperscale DCI with 400ZR pluggables |

| Enterprise WAN | Merchant | Lower volumes, ecosystem flexibility, IT-friendly integration | Enterprise 100G/400G ZR deployments |

Recent Industry Deployments (2024-2025)

Ciena WaveLogic 6 Deployments

Ciena has secured over 20 WaveLogic 6 Extreme customers in Q1 2025 alone. Key deployments include Telstra's 1.6 Tb/s demonstration over 736 km of installed fiber in Australia, and Southern Cross Networks' modeled 1 Tb/s capacity over 13,500 km trans-Pacific submarine routes. WL6 technology enables "800G Anywhere" capability, closing 800 Gb/s links using robust QPSK modulation over transoceanic distances where merchant solutions would require 16QAM with dramatically reduced reach.

Nokia/Infinera Merger Integration

Following the February 2025 merger completion, Nokia-Infinera has combined PSE-6s and ICE7 portfolios. The merged entity targets €200M net synergies by 2027 with 10%+ EPS accretion. Infinera's design wins, valued at hundreds of millions in 800ZR/ZR+ pluggable commitments, complement Nokia's strong carrier relationships. The combined optical networking powerhouse now controls both leading in-house DSP platforms and significant merchant-compatible pluggable volume.

Hyperscaler 800ZR Adoption and Vertical Integration Trends

The "big four" hyperscalers—Google, Microsoft, Meta, and AWS—have adopted distinctly different coherent optical strategies that collectively shape the merchant DSP market. According to Cignal AI, these cloud providers now drive 60% YoY growth in DWDM purchasing (versus 5% for total market in H1 2025), with pluggable coherent accounting for over 70% of coherent bandwidth deployed in 2024.

Microsoft—The 400ZR Pioneer, Waiting for 1600ZR: As the largest 400ZR user globally, Microsoft pioneered the hyperscaler adoption of pluggable coherent optics. Microsoft was a principal backer of the original OIF 400ZR work alongside Google starting in 2016, targeting regional data center interconnects up to 80-120 km. However, Microsoft has announced it will not adopt 800ZR, instead following a 1:4:16 upgrade path (400G→1600G) and waiting for 1600ZR technology expected circa 2027. This strategic patience reflects Microsoft's assessment that changing switching infrastructure for a 2× upgrade is not worth the effort when 4× (1.6T) is only a few years away. Microsoft presented at OFC 2025 on the transition from 400G to 1600G deployment, emphasizing AI/ML-driven bandwidth demands and intelligent network operations.

Google—The Standards Driver: Google was the primary promoter of the OIF 800ZR specification, which kicked off in November 2020. Unlike Microsoft, Google and Meta have adopted more flexible upgrade paths, planning to utilize 800ZR in some network segments and 1600ZR in others based on specific application requirements. Google has defined specific "Long-Haul Coherent Pluggable ZR+" requirements and is actively promoting pluggable firmware upgrade standardization within OIF to enable universal standards across platforms and module vendors. At OFC 2025, Google's Jason Wang participated in OIF panels on coherent optics advancement, emphasizing the importance of backward compatibility for 400G-to-800G upgrades and standardized PCS modes.

Meta—AI Infrastructure at Scale: Meta has invested aggressively in optical infrastructure to support AI training clusters, committing $66-72 billion in 2025 CapEx (up 70% from 2024) with "similarly significant" growth projected for 2026. Meta's "10× Backbone" initiative has transformed their network through IP/optical integration using ZR technology, eliminating standalone transponders and recovering significant space and power. Key optical initiatives include:

- Deployed optics: 2×400G FR4 BASE (3-km) optics supporting 51T platforms across backend/frontend networks

- New variants: 2×400G FR4 LITE (500-m) optimized for majority of intra-datacenter use cases

- AI cluster connectivity: 400G DR4 OSFP-RHS for host-side NIC and 2×400G DR4 for switch-side connections

- Prometheus cluster: 1-gigawatt AI cluster spanning multiple data center buildings requiring distributed training across geographically distributed sites

Meta identifies "advanced optical solutions" as the only viable path to increasing shoreline beyond 3.2T and moving beyond backplane constraints. The company is actively engaging in research on higher performance, more reliable optical interconnects and has been a founding participant in the ESUN (Ethernet for Scale-Up Networking) initiative within OCP at the 2025 Global Summit.

AWS In-House Optical Development: In a significant industry shift, AWS has developed proprietary DWDM transponder technology for both metro and long-haul routes, representing the first significant whitebox optical system deployment by a hyperscaler. Development began in 2020 targeting metro networks, with updated architecture in January 2024 supporting unified data center, metro, and long-haul connections. Key achievements include:

- Metro deployment: Upgraded iteration deployed on metro networks by February 2025

- Long-haul milestone: First 1,500-km connection went live in July 2025

- Performance gains: 73% bandwidth increase and 35% power reduction versus vendor-sourced equipment

- Flexibility: Supports multiple technology generations and any fiber type with flexible bandwidth options

- Strategic rationale: Full software/hardware control enabling security verification of every byte, rapid updates, deep network management integration, and supply chain continuity

AWS has explicitly stated it will not sell its proprietary optical technology externally, focusing instead on "providing the best network for AWS customers" while acknowledging that "existing DWDM vendors do a great job supporting the diverse needs of the market." This positions AWS's in-house development as a strategic capability differentiator rather than a competitive threat to optical equipment vendors.

Hyperscaler Strategy Summary: These divergent approaches illustrate the market segmentation: Microsoft prioritizes standardization and long upgrade cycles; Google drives standards development while maintaining flexibility; Meta invests heavily in AI-optimized optical infrastructure; and AWS pursues vertical integration for maximum control. The OIF 800ZR Implementation Agreement, released October 2024, has already driven multi-vendor interoperability demonstrations with 35+ participating companies at OFC 2025, validating the ecosystem's readiness for 800G DCI deployment at scale.

OIF has launched both 1600ZR and 1600ZR+ initiatives, targeting 1.6 Tb/s interoperable coherent interfaces. The specification will likely require ~240 GBaud symbol rates, doubling 800ZR's 118 GBaud, while maintaining the 28W module power envelope. First products are expected circa 2027, with IEEE 802.3dj working group targeting electrical/optical interface standards by H2 2026. This represents the first time OIF has addressed both ZR and ZR+ variants simultaneously. OIF recently launched the 1600 Coherent Light (CL) project at Q4 2024 meetings to support larger data center campuses with improved power efficiency versus 1600ZR for long-reach applications.

Unlock Premium Content

Join over 400K+ optical network professionals worldwide. Access premium courses, advanced engineering tools, and exclusive industry insights.

Already have an account? Log in here