6 min read

Challenges for Multi-vendor Optical Line System Integration

Practical Information Based on Experience and Industry RequirementsIntroduction

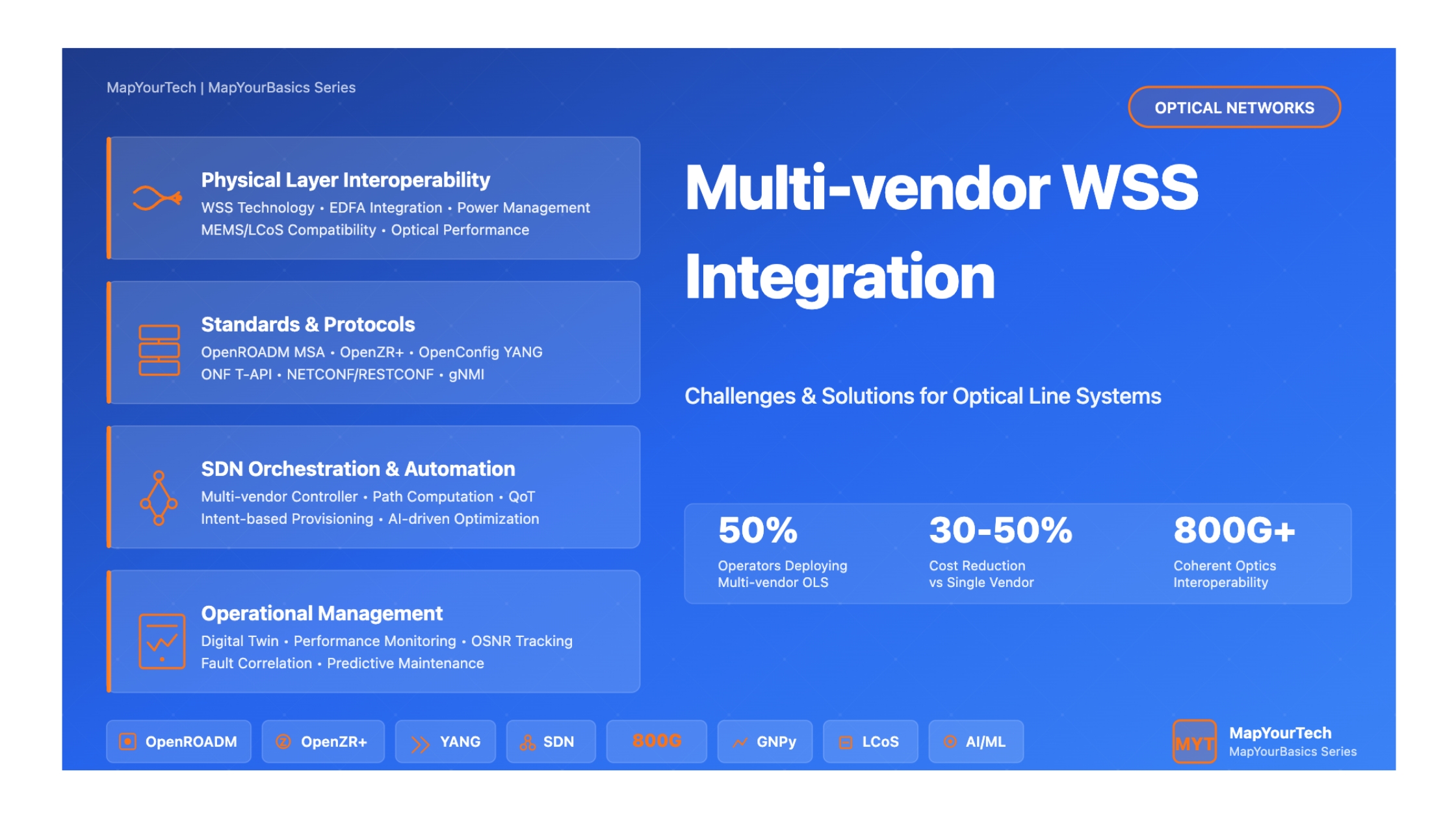

The telecommunications industry is experiencing a fundamental transformation in optical network architecture. Multi-vendor Wavelength Selective Switch (WSS) integration within Optical Line Systems (OLS) represents a strategic evolution from traditional, monolithic network designs toward open, disaggregated, and software-defined infrastructures. This shift is driven by compelling business imperatives including cost optimization through vendor competition (achieving 30-50% capital savings), enhanced network resilience, innovation acceleration, and the critical need to avoid vendor lock-in.

As of 2025, approximately 50% of network operators have deployed or are planning to deploy disaggregated, multi-vendor optical line systems, signaling a fundamental shift in network architecture philosophy. This comprehensive guide examines the technical complexities, architectural considerations, standardization efforts, and operational challenges associated with multi-vendor WSS integration, providing network professionals with practical insights drawn from real-world deployments and industry best practices.

Why Multi-vendor Integration Matters: The global optical transport network market is valued at USD 27 billion in 2025 and projected to reach USD 40.44 billion by 2030, with multi-vendor interoperability becoming a cornerstone of this growth. Network operators require flexible capacity movement across any path (71% of operators) and the ability to easily connect new locations with minimal physical interventions (66% of operators).

The architecture diagram above illustrates a typical multi-vendor optical line system where different network components are sourced from various manufacturers. This disaggregated approach enables operators to select best-of-breed solutions for each layer while maintaining interoperability through standardized interfaces and protocols. The SDN controller provides unified orchestration across all vendor domains, abstracting the complexity of multi-vendor management.

Historical Context & Evolution of Multi-vendor Optical Networks

From Proprietary to Open: The Industry Transformation

The evolution of optical networking has undergone three distinct phases. The first generation (1990s-2005) was characterized by fully proprietary, vertically integrated solutions where single vendors controlled all aspects from transponders to line systems. This era prioritized reliability and simplified operations but created significant vendor lock-in and limited innovation.

The second generation (2006-2015) introduced partial disaggregation with the emergence of alien wavelength support, allowing transponders from one vendor to operate over another vendor's line system. However, integration complexity remained high, and performance optimization was challenging across vendor boundaries.

The current third generation (2016-present) represents full disaggregation enabled by comprehensive standardization efforts. Organizations including OIF (Optical Internetworking Forum), OpenROADM MSA, OpenZR+ MSA, and OpenConfig have collectively defined specifications for optical and control plane interoperability, fostering an ecosystem where components from different manufacturers can interoperate seamlessly.

Key Technological Breakthroughs

Several technological advancements have been instrumental in enabling multi-vendor integration. The development of flexible-grid wavelength selective switches (WSS) based on Liquid Crystal on Silicon (LCoS) technology provides the granular spectral control needed to support diverse transponder technologies. Coherent detection with advanced digital signal processing (DSP) enables transponders to compensate for various line system impairments, improving tolerance to multi-vendor optical paths.

Software-defined networking (SDN) controllers using standardized YANG models (OpenConfig, OpenROADM) provide vendor-neutral management interfaces, dramatically simplifying multi-vendor orchestration. The emergence of open-source tools like GNPy (Gaussian Noise model in Python) for quality of transmission (QoT) estimation enables operators to predict optical performance in mixed-vendor environments without proprietary optimization algorithms.

2025 Market Trends: The optical transport network market is experiencing 8.42% CAGR growth, with DWDM systems accounting for 62% revenue share. Migration to 800G wavelengths is accelerating, while above-400 Gbps data rates show the fastest growth at 8.32% CAGR. Hyperscale operators are channeling USD 215 billion into digital infrastructure in 2025, intensifying demand for multi-vendor interoperable high-capacity systems.

Core Concepts & Fundamentals

Wavelength Selective Switch (WSS) Technology

A Wavelength Selective Switch serves as the central component in modern Reconfigurable Optical Add-Drop Multiplexers (ROADMs), enabling dynamic routing and power control of individual wavelengths without optical-electrical-optical conversion. The WSS performs two critical functions: wavelength switching (directing specific wavelengths from any input port to any desired output port) and power level adjustment (applying programmable attenuation to each wavelength channel independently for power equalization).

Three primary WSS technologies compete in the market, each with distinct characteristics:

MEMS (Micro-Electro-Mechanical Systems): Uses arrays of microscopic tilting mirrors fabricated on silicon substrates to steer light beams. MEMS-based WSS offers proven reliability and is widely deployed, but typically supports fewer ports (8-20 degrees) compared to alternatives. Digital MEMS platforms provide stable operation but are not inherently capable of supporting flexible-grid functionality where channel width is variable.

Liquid Crystal (LC): Employs liquid crystal cells as optical switches by altering polarization states through applied voltage. LC-based devices can be engineered to support flexible-grid operation with optimized designs, offering a middle ground between MEMS and LCoS technologies.

Liquid Crystal on Silicon (LCoS): Represents the most advanced WSS technology, utilizing a high-resolution LCoS chip with liquid crystal layers on top of a CMOS backplane containing millions of pixels. By controlling voltage applied to each pixel, a programmable phase-holographic diffraction grating is created, allowing extremely precise and flexible light beam manipulation. LCoS technology is inherently suited for flexible-grid operation, supporting channels with arbitrary widths and center frequencies, making it the preferred choice for modern multi-vendor deployments.

Optical Line System Architecture

A modern Open Line System comprises several key components working in concert. At the heart are Reconfigurable Optical Add-Drop Multiplexers (ROADMs) utilizing WSS technology for wavelength routing. These are interconnected by fiber spans with optical amplifiers (primarily Erbium-Doped Fiber Amplifiers - EDFAs for C-band and L-band, supplemented by Raman amplification for extended reach).

The architecture supports "alien wavelengths" - optical signals from third-party transponders traversing the line system. This capability requires careful power management and standardized interfaces to ensure signal quality across vendor boundaries. Optical Supervisory Channels (OSC), typically at 1510nm or 1610nm wavelengths separate from data channels, enable equipment communication and monitoring across the line system.

Two primary disaggregation models have emerged in practice. Partial disaggregation separates transponders from optical line systems while maintaining single-vendor line systems, providing transponder flexibility with manageable complexity. This approach has been adopted by 48% of operators as an initial step toward full disaggregation.

Full disaggregation enables mixing equipment from different vendors at every network layer - transponders, amplifiers, ROADMs, and WSS units. While offering maximum flexibility and access to best-of-breed components, this approach requires extensive standardization, careful integration planning, and sophisticated management systems to handle the increased operational complexity.

Technical Architecture & Component Integration

Multi-vendor Integration Patterns

Three architectural patterns have proven successful for multi-vendor deployments, each with specific use cases and trade-offs. Domain-separated architectures maintain single-vendor domains connected through standardized interfaces at network boundaries. This approach simplifies troubleshooting and maintains vendor-optimized performance within each domain while requiring robust gateway functionality for inter-domain communication.

Component-mixed architectures combine equipment from multiple vendors within the same network domain, maximizing flexibility and competitive procurement but demanding sophisticated management systems and extensive pre-deployment testing. This pattern is most common in greenfield deployments where operators can design from the ground up for multi-vendor operation.

Hybrid architectures blend both approaches, typically maintaining single-vendor optical line systems (OLS) where interoperability is most challenging, while allowing multiple vendors in the transponder layer with common modulation formats and FEC (Forward Error Correction). This pragmatic middle path reduces risk while still delivering substantial flexibility and cost benefits.

.Component-Level Interoperability

Transponder Compatibility: Modern coherent transponders have achieved significant interoperability progress through standards like OIF 400ZR and OpenZR+. These specifications define modulation formats (QPSK, 8QAM, 16QAM), symbol rates, forward error correction schemes, and management interfaces, enabling multi-vendor operation. The Digital Signal Processor (DSP) plays a crucial role, compensating for various line system impairments including chromatic dispersion, polarization mode dispersion (PMD), and nonlinear effects, making transponders more tolerant of multi-vendor optical paths.

However, proprietary implementations still offer performance advantages. Vendors using advanced techniques like probabilistic constellation shaping (PCS) can achieve 15-20% capacity improvements over standards-based implementations, creating trade-offs between interoperability and maximum capacity. As of 2025, 800G coherent pluggables based on 3nm DSP technology are becoming commercially available, featuring multi-vendor interoperability with PCS modes and significantly reduced power consumption.

Amplifier Integration: Optical amplifiers from different vendors can be mixed, but careful planning is essential. Erbium-Doped Fiber Amplifiers (EDFAs) have varying gain profiles between manufacturers, potentially creating spectral ripple when cascaded. Gain flattening filters help normalize responses but add insertion loss (typically 1-2 dB) and cost. The gain spectrum flatness specification becomes critical in multi-vendor deployments - maintaining ±0.5dB flatness across the C-band requires careful amplifier selection and possibly dynamic gain equalization.

Raman amplification in multi-vendor environments requires particular attention to pump power levels and control strategies, which differ between vendors. The distributed nature of Raman gain makes it sensitive to fiber characteristics, complicating multi-vendor integration. Some operators choose to maintain single-vendor amplifier chains while diversifying transponder suppliers, representing a pragmatic compromise that balances flexibility with optical performance.

Standards and Protocols Enabling Multi-vendor Interoperability

OpenROADM Multi-Source Agreement

The OpenROADM MSA has emerged as the most comprehensive framework for optical disaggregation, with Version 8.0.1 (released March 2025) supporting everything from basic ROADM control to advanced features like optical restoration and spectrum sharing. Major operators including AT&T, Orange, and Verizon have deployed OpenROADM-compliant networks at scale, demonstrating the standard's maturity and industry acceptance.

OpenROADM's strength lies in its completeness - unlike other standards focusing on specific aspects, it defines device models, network models, and service models in an integrated fashion. YANG data models provide consistent management interfaces across vendors, while optical specifications ensure interoperability at the photonic layer. The standard specifies critical parameters including launch power (-1 to +2 dBm per channel typical), per-channel power control (±15 dB range), PMD tolerance (up to 20 ps), common FEC schemes (SD-FEC with 25% overhead), and OTDR specifications for fiber monitoring.

OpenROADM Deployment Reality: While OpenROADM provides comprehensive specifications, real-world deployments reveal that intense coordination and detailed YANG version tracking are required to avoid conflicts. Every new vendor element must undergo extensive interoperability testing against the reference model. However, operators who invest in proper validation report successful multi-vendor ROADM deployments with performance comparable to single-vendor solutions.

OpenConfig and OpenZR+ Standards

OpenConfig has gained substantial traction for multi-vendor management of terminal devices and optical transport equipment. Its optical transport models (version 1.9.2 as of 2025) cover transponders, amplifiers, and wavelength routers with vendor-neutral YANG definitions. The strength of OpenConfig lies in its streaming telemetry capabilities using gNMI (gRPC Network Management Interface), enabling real-time performance monitoring crucial for proactive network management.

Combined with OpenROADM, operators can achieve consistent management across vendors while retaining access to unique features through vendor extensions. However, practical implementation reveals challenges - Heavy Reading surveys found that "the use of native OpenConfig YANG models resulted in low test coverage" and "most participating vendors implemented OpenConfig YANG extensions," indicating that while standards aim for openness, practical interoperability often requires vendor-specific adaptations.

The OpenZR+ MSA extends the OIF 400ZR specification to support longer reach applications beyond data center interconnect. While 400ZR defines a basic 120km reach interoperable specification, OpenZR+ adds capabilities for metro and regional networks including extended reach (up to 1000km), higher launch powers (up to +4 dBm), enhanced monitoring, and support for colored/tunable wavelengths. As of 2025, OpenZR+ has expanded to 800ZR+ specifications, with multi-vendor interoperability demonstrations showing successful 800G transmissions over 500km distances.

ONF Transport API (T-API)

The Open Networking Foundation's Transport API provides service-level abstraction above device-specific models, enabling hierarchical orchestration in multi-domain networks. T-API focuses on connectivity services, allowing higher-layer systems (OSS/BSS) to request optical connectivity without needing to understand vendor-specific ROADM configurations. This abstraction is particularly valuable in multi-vendor environments where a single orchestrator must coordinate resources across diverse equipment.

T-API version 3.0 supports advanced features including topology discovery, path computation coordination, and intent-based networking. The combination of T-API for service abstraction, OpenConfig/OpenROADM for device configuration, and GNPy for QoT validation creates a complete multi-vendor management stack that several operators have successfully deployed at scale.

Technical Challenges and Limitations

Interoperability Complexity at Physical Layer

Despite standards progress, significant technical challenges remain at the physical layer. WSS integration presents particular difficulties due to fundamental technology differences. MEMS-based switches from one vendor may have switching speeds of 10-15ms and support 8-12 ports, while LCoS-based switches from another vendor might offer <5ms switching and 20+ ports. These differences complicate network planning, particularly for protection switching applications where restoration time is critical.

Power level coordination across vendor boundaries requires meticulous attention. Different amplifiers have varying gain profiles - an EDFA from Vendor A might have gain ripple of ±0.3dB across C-band, while Vendor B's amplifier shows ±0.5dB variation but at different wavelengths. When cascaded, these ripples can add constructively, necessitating per-channel power adjustments to maintain signal quality. Without proper coordination, performance degradation cascades through multi-vendor chains, with OSNR degradation accumulating faster than in optimized single-vendor deployments.

Real-world Impact: Multi-vendor networks typically require conservative margin allocation (3-5 dB additional margin) compared to single-vendor solutions where vendors optimize equipment to work together with tighter tolerances. This reality means multi-vendor networks may sacrifice 15-25% capacity to ensure reliable operation across all vendor combinations and environmental conditions.

Performance Optimization Challenges

Troubleshooting becomes exponentially more complex when issues span vendor boundaries. Root cause analysis requires understanding interactions between different vendors' equipment, often without access to proprietary diagnostic information. For example, when OSNR degrades unexpectedly, is it due to: (1) Excessive noise from Vendor A's amplifier, (2) Higher-than-expected losses in Vendor B's WSS, (3) Fiber nonlinearity accumulation that neither vendor's planning tool accurately predicted, or (4) Interaction effects between vendors' different PMD compensation algorithms?

This challenge necessitates enhanced monitoring and correlation capabilities. Successful operators deploy AI-driven fault correlation systems that learn fault patterns across vendor boundaries. These systems use machine learning to identify complex fault signatures that span multiple vendors, dramatically reducing mean time to repair from hours to minutes in mature deployments.

Quality of Transmission (QoT) estimation becomes critical yet challenging in multi-vendor environments. Single-vendor proprietary planning tools optimize for their equipment's characteristics. In multi-vendor networks, operators must rely on vendor-neutral tools like GNPy, which implements the Gaussian Noise (GN) model for nonlinear interference estimation. While academic studies show GNPy accuracy within 0.5-1dB of measured OSNR for well-characterized systems, achieving this accuracy requires detailed knowledge of all components' characteristics - information not always readily available from vendors.

Operational Complexity Management

The shift to multi-vendor operations demands new skills and processes. Network planners must understand multiple vendors' capabilities and limitations - not just specifications, but practical implementation nuances. Operations teams need expertise across diverse platforms, with training requirements increasing substantially. A single-vendor network might require operators to master one EMS (Element Management System); a three-vendor network requires proficiency with three different EMS platforms, each with its own interface paradigms, alarm nomenclature, and troubleshooting workflows.

Integration testing represents another significant challenge. Each new software release or hardware addition requires validation across vendor boundaries. Organizations must establish comprehensive test environments - ideally representative labs containing actual production equipment from all vendors - and detailed procedures to ensure changes don't disrupt multi-vendor interoperability. Mature operators report spending 2-3x more effort on integration testing compared to single-vendor scenarios, though this overhead decreases with experience and improved automation.

Network Management, Orchestration, and Automation

SDN Controller Architecture

Software-defined networking provides the essential abstraction layer for managing multi-vendor optical networks. Leading open-source platforms including ONOS (Open Network Operating System) and OpenDaylight have demonstrated successful multi-vendor ROADM control in production deployments. These controllers use southbound interfaces (NETCONF/YANG, RESTCONF, gNMI) to communicate with network elements, translating high-level service requests into vendor-specific configurations.

The controller architecture typically includes several specialized applications: a topology manager that discovers network elements and builds a unified view, a path computation engine that finds optimal routes considering optical constraints, a wavelength assignment module that allocates spectrum avoiding conflicts, and a provisioning application that translates service requests into element configurations. Additionally, a QoT estimator (often GNPy integration) validates that computed paths will meet performance requirements before actual provisioning.

Real-world deployments demonstrate that SDN controllers can successfully manage networks with 3-5 different vendor domains. Verizon's multi-vendor optical network, managed by a custom SDN controller, handles over 15,000 network elements across multiple vendors using standardized YANG models. The key to success is comprehensive pre-deployment testing and a phased rollout approach that validates each vendor integration independently before combining them.

Automation and Intent-based Networking

Modern orchestration platforms support intent-based provisioning, where operators specify service requirements (e.g., 100G connection from Site A to Site B with <10ms latency and 99.99% availability ) and the system automatically determines optimal routes, configures appropriate resources across multiple vendors, and monitors service health. This abstraction dramatically reduces operational complexity and human error.

Machine learning applications are increasingly critical for multi-vendor optical networks. Key use cases include predictive maintenance (analyzing telemetry patterns to predict equipment failures 48-72 hours in advance), traffic forecasting (predicting capacity needs to enable proactive capacity additions), QoT prediction (learning actual system performance to improve planning tool accuracy), and anomaly detection (identifying subtle performance degradations that might indicate emerging issues).

Real-world deployments demonstrate substantial benefits. One major European operator using AI-driven automation reported 60% reduction in service provisioning time (from 3 weeks to 1 week average), 40% decrease in operational errors, and 25% improvement in network utilization through more aggressive capacity planning enabled by better QoT prediction.

Digital Twin and Network Modeling

The concept of a "physical layer digital twin" - a real-time virtual replica of the optical network - is emerging as essential for multi-vendor network management. The digital twin combines physical models (GNPy for QoT estimation, fiber plant databases, equipment specifications) with live telemetry (streaming data from all network elements) to create an always-current simulation environment.

This digital twin enables several powerful capabilities: what-if analysis (simulating proposed changes before implementation to predict impact), root cause analysis (comparing actual vs. expected performance to isolate faults), capacity planning (accurately predicting how additional traffic or new routes will affect existing services), and automated optimization (continuously adjusting network parameters to maximize performance and capacity).

Leading operators are investing heavily in digital twin technology. Implementation requires substantial effort - comprehensive equipment characterization, accurate fiber plant data, high-frequency telemetry collection (1-minute intervals or faster), and sophisticated correlation engines - but operators who achieve mature digital twin capabilities report dramatic improvements in network reliability and operational efficiency.

Practical Applications, Deployments, and Case Studies

Use Case 1: Data Center Interconnect (DCI)

Data center interconnect represents one of the most successful multi-vendor deployment scenarios. Hyperscale cloud operators value the flexibility to choose optimal transponders for specific routes while maintaining common optical line systems. The explosive growth in DCI traffic (driven by cloud services, content delivery, and AI workloads) has accelerated adoption of pluggable coherent optics from multiple vendors.

A typical DCI deployment might use 400ZR pluggable transponders from Vendor A (selected for superior power efficiency in short-reach applications) and Vendor B (chosen for extended reach capability), operating over an open line system from Vendor C. The OLS provides standardized interfaces at each data center, allowing seamless integration of any compliant transponder. OpenZR+ specifications ensure interoperability, with multi-vendor testing validating that transponders from different manufacturers can communicate reliably.

Quantitative benefits are substantial. Cloud operators report 30-40% cost savings compared to single-vendor solutions through competitive procurement, ability to rapidly adopt newest technology from any vendor (reducing technology refresh cycles from 3-5 years to 18-24 months), and improved supply chain resilience (eliminating single points of failure).

Use Case 2: Long-haul Metro Network Modernization

Regional telecommunications operators frequently face the challenge of modernizing networks that have accumulated equipment from multiple vendors through acquisitions, organic growth, and technology refresh cycles. Rather than expensive forklift upgrades to a single vendor, modern approaches embrace the multi-vendor reality and implement unified management layers.

Consider a Tier 1 operator with 2000km metro network containing three vendor domains from past acquisitions. The operator implemented a phased multi-vendor integration: deployed SDN controller (ONOS-based) with OpenROADM and OpenConfig southbound interfaces, standardized on OpenROADM-compliant ROADMs at major hubs, implemented GNPy-based path computation for cross-vendor route planning, and deployed unified monitoring using streaming telemetry and AI-powered fault correlation.

Results after 18 months: 45% reduction in operational expenses through unified management, 70% faster service provisioning (from 14 days to 4 days average), capacity increase of 35% through better optimization without additional equipment, and improved network availability (from 99.95% to 99.98%) through faster fault detection and resolution.

Use Case 3: Brownfield Network Evolution

The most common multi-vendor adoption scenario involves gradual introduction of new vendors during capacity expansions or technology refreshes. This phased approach minimizes disruption while enabling cost optimization and feature enhancement.

A large Asian operator provides an instructive example. Starting with a single-vendor network deployed over 10 years, they implemented multi-vendor strategy across three phases:

Phase 1 (Year 1-2): Introduced second vendor for transponders only, maintaining single-vendor OLS. Validated OpenConfig management, established integration testing procedures, trained operations staff on multi-vendor troubleshooting. Result: 25% transponder cost reduction, minimal operational disruption.

Phase 2 (Year 3-4): Deployed third-vendor ROADMs at new sites, implemented SDN controller for unified management, migrated existing sites to OpenROADM-compliant hardware during refresh cycles. Result: Full vendor diversification at new builds, 40% reduction in ROADM procurement costs.

Phase 3 (Year 5+): Enabled full component mixing at all sites, implemented AI-driven automation and digital twin, achieved true multi-vendor operations with seamless management. Result: Best-of-breed technology selection, accelerated innovation adoption, operational efficiency comparable to single-vendor networks.

Lessons Learned from Real Deployments

Analysis of production multi-vendor networks reveals several critical success factors. First, comprehensive testing before production is non-negotiable. Operators who skipped detailed lab validation experienced 3-5x higher incident rates in the first year. Successful deployments invested 3-6 months in integration testing, validating not just basic connectivity but also failure scenarios, software upgrade paths, and performance under stress.

Second, phased rollout strategies minimize risk. Starting with non-critical routes, gradually expanding to production traffic as confidence builds, proves far more successful than big-bang deployments. Operators using phased approaches reported 60% fewer service-affecting incidents.

Third, operational training and documentation are as important as technical integration. Multi-vendor networks require operations staff to understand multiple systems, troubleshooting procedures that span vendor boundaries, and when to escalate to which vendor. Mature operators invest heavily in training programs, internal documentation, and cross-functional teams that include members familiar with each vendor's equipment.

Fourth, vendor engagement and support structures matter enormously. Successful deployments establish clear escalation procedures, joint troubleshooting protocols between vendors (when issues span boundaries), and regular technical interchange meetings. Some operators use third-party system integrators who specialize in multi-vendor optical networks to provide vendor-neutral expertise.

Future Trends and Industry Outlook

800G and Beyond: Next-Generation Coherent Optics

The industry is rapidly advancing toward 800G and 1.6T wavelengths with multi-vendor interoperability. As of 2025, 800G coherent optics based on 3nm DSP technology are becoming commercially available, featuring multi-vendor interoperable probabilistic constellation shaping, 50% power consumption reduction compared to previous generations, and extended reach capabilities (1000km+ for some modes). Field trials demonstrate successful 800G transmissions over multi-vendor optical line systems, with OSNR margins comparable to single-vendor deployments.

Looking further ahead, 1.6T per wavelength systems are in advanced development, with initial deployments expected in 2026-2027. These systems will leverage even more advanced modulation formats (up to 64QAM), multi-dimensional coding, and spatial division multiplexing techniques. The challenge for multi-vendor interoperability will be ensuring these advanced capabilities work reliably across vendor boundaries.

AI-Driven Automation and Zero-Touch Networking

The convergence of multi-vendor optical networks and AI-powered automation represents the industry's future direction. Zero-touch provisioning - where service requests are automatically translated into network configurations without human intervention - is becoming reality in leading networks. AI applications extend across the entire lifecycle: network planning (optimizing topology and capacity placement), service provisioning (automated path computation and resource allocation), performance optimization (continuous tuning of network parameters), predictive maintenance (forecasting failures before they occur), and capacity management (automated traffic forecasting and upgrade planning).

Machine learning models trained on multi-vendor network telemetry can achieve remarkable results. One operator reports their AI-driven system predicts component failures with 85% accuracy 48-72 hours in advance, enabling proactive maintenance that has reduced unplanned outages by 60%. Another operator's ML-based QoT prediction system has improved accuracy to within 0.3dB of measured OSNR, enabling more aggressive capacity planning and 20% improvement in spectral efficiency.

Pluggable Optical Line Systems (POLS)

An emerging trend is Pluggable Optical Line Systems (POLS), which integrate elements traditionally found in rack-mounted OLS equipment - multiplexing/demultiplexing and variable-gain amplification - directly into pluggable form factors (OSFP or QSFP). This further consolidates network functions, simplifying deployments especially in metro and access networks. POLS represents the next evolution of disaggregation, where even amplification moves into the pluggable domain.

For multi-vendor networks, POLS could both simplify and complicate matters. Simplification comes from reduced component count and standardized interfaces. Complications arise from needing to ensure POLS from different vendors interoperate properly, manage distributed gain control across vendor boundaries, and coordinate power levels in networks where amplification is distributed rather than centralized.

Open RAN and IP-Optical Convergence

The convergence of IP routing and optical transport layers continues accelerating, with coherent DWDM optics integrated directly into routers (IP over DWDM). This eliminates separate transponder shelves, reducing capital expenditure, minimizing footprint, and achieving substantial power savings. Multi-vendor considerations extend into this converged architecture - routers from one vendor must work seamlessly with optical line systems from another.

The Open RAN movement in wireless networks mirrors optical networking's journey toward openness and disaggregation. Many of the same principles apply: standardized interfaces (O-RAN specifications analogous to OpenROADM), vendor-neutral management (RAN Intelligent Controllers similar to optical SDN), and component disaggregation. Knowledge transfer between these domains is accelerating both movements.

Industry Trajectory: Toward Fully Open Networks

The trajectory is clear: optical networking is moving inexorably toward fully open, disaggregated, multi-vendor architectures. Current adoption (50% of operators deploying or planning multi-vendor solutions as of 2025) will likely reach 75-80% by 2028 based on industry forecasts. This shift is driven by undeniable benefits - cost reductions of 30-50%, innovation acceleration, supply chain resilience, and avoidance of vendor lock-in.

However, challenges remain. Physical layer interoperability continues to require careful engineering and conservative margins. Operational complexity demands sophisticated management systems and well-trained staff. Standards evolution must keep pace with technology advancement - ensuring 1.6T, 3.2T, and future wavelengths have interoperability specifications ready when hardware becomes available.

The future of optical networking points toward highly flexible, automated, and economically efficient networks where multi-vendor interoperability is not merely an option but a fundamental cornerstone of design and operation. Success will require continued collaboration between operators, vendors, standards bodies, and open-source communities - but the benefits make this investment worthwhile for the global telecommunications ecosystem.

Key Takeaways

1. Multi-vendor Integration is Now Mainstream: 50% of operators have deployed or are deploying disaggregated multi-vendor optical networks as of 2025, driven by 30-50% cost savings and strategic flexibility.

2. Standards Are Essential but Not Sufficient: OpenROADM, OpenZR+, and OpenConfig provide necessary frameworks, but practical interoperability requires extensive testing, operational procedures, and vendor collaboration.

3. Physical Layer Complexity Remains: WSS technology differences (MEMS vs LCoS), amplifier gain profile variations, and power level coordination across vendor boundaries require sophisticated engineering and conservative margins.

4. SDN and Automation Are Critical Enablers: Unified orchestration via SDN controllers, intent-based networking, and AI-driven automation transform multi-vendor complexity from a liability into manageable operational reality.

5. QoT Estimation Tools Are Non-Negotiable: Vendor-neutral tools like GNPy for optical performance prediction are essential for reliable multi-vendor network planning and operation.

6. Phased Deployment Strategies Minimize Risk: Successful multi-vendor deployments use staged approaches - starting with transponder diversity, advancing to partial disaggregation, and culminating in full component mixing.

7. Operational Readiness Determines Success: Training, documentation, troubleshooting procedures, and vendor support structures are as important as technical integration for multi-vendor success.

8. 800G and 1.6T Are Driving Next Wave: Next-generation coherent optics with multi-vendor interoperability are accelerating adoption, with substantial performance and efficiency improvements.

9. Digital Twins and AI Transform Operations: Physical layer digital twins combined with ML-driven automation enable proactive management, predictive maintenance, and optimal resource utilization.

10. The Future Is Fully Disaggregated and Automated: Industry trajectory points toward networks where multi-vendor interoperability is foundational, operations are AI-driven, and zero-touch provisioning is the norm.

Developed by MapYourTech Team

For educational purposes in optical networking and telecommunications systems

Unlock Premium Content

Join over 400K+ optical network professionals worldwide. Access premium courses, advanced engineering tools, and exclusive industry insights.

Already have an account? Log in here